According to the latest Mazars study on cash flow forecasts within companies with a turnover of more than € 2 billion, 8 out of 10 major groups use a Treasury Management System (TMS). However, nearly all the treasurers of these groups are still big consumers of Excel workbooks. These complement the TMS, whose functional coverage is still relatively limited. And for groups whose turnover does not exceed € 2 billion, Excel is often the only tool used for cash management.

Why is Excel still so popular? What are its main advantages and disadvantages? Are TMS an alternative or a complement to our dear spreadsheet?

Flexibility versus Rigidity

With an Excel spreadsheet, everything is possible! Tables with multiple and varied entries, endless formulas, numerous versions … The treasurer has carte blanche to create the document of his dreams. Be careful though to lock it correctly, if you do not want errors to slip in.

With an Excel spreadsheet, everything is possible! Tables with multiple and varied entries, endless formulas, numerous versions … The treasurer has carte blanche to create the document of his dreams. Be careful though to lock it correctly, if you do not want errors to slip in.

The TMS software, on the other hand, is logically much more rigid. It can be beneficial to require all staff and subsidiaries in a group to homogenize their processes and implement certain “good practices” that are inherently present in the software. However, the functionalities provided by the publisher (Sage, Kyriba, Diapason or even Misys …) are limited and difficult to change. It will therefore often be difficult, if not impossible, to produce complex output, such as actual cash flow tables.

Customization versus Standardization

TMS rigidity can offer guarantees of sustainability for large groups. Take the case of a treasurer who leaves his company after 10 years of good and loyal service. If he only based his work on Excel, taking over the position will be very difficult for his replacement. With the framework required by the TMS software, the transfer will be facilitated since the processes are integrated within the solution.

TMS rigidity can offer guarantees of sustainability for large groups. Take the case of a treasurer who leaves his company after 10 years of good and loyal service. If he only based his work on Excel, taking over the position will be very difficult for his replacement. With the framework required by the TMS software, the transfer will be facilitated since the processes are integrated within the solution.

However, this standardization can be disabling in many cases. For international groups, for example, a subsidiary is not always 100% owned by the parent company. It is thus necessary to be able to weight the figures it reports, which is not provided for in the standards set up by the TMS. The TMS is thus useless in producing reliable reporting at the group level. In this case, the corporate treasurer has no choice and must rely on … Excel.

Global versus Local

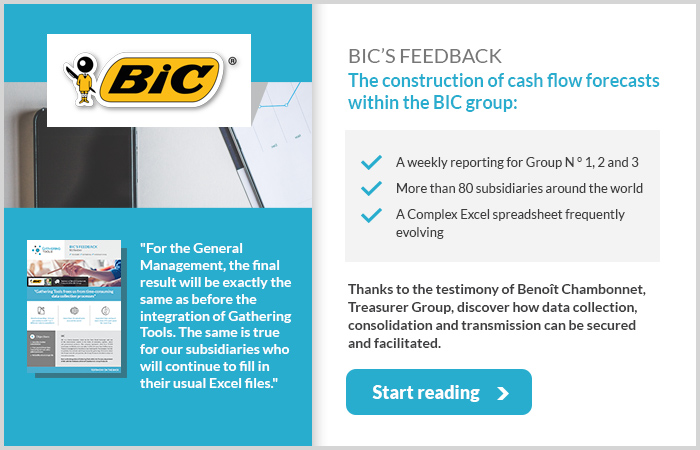

Excel is therefore once again making sense. It is a global tool that every treasurer knows perfectly, anywhere in the world. To organize reporting from subsidiaries, nothing can beat an Excel template to send to each treasurer. This obviously requires a flawless organization in order to monitor the answers of each and to ensure the consistency of the results, but it is a method that works!

Excel is therefore once again making sense. It is a global tool that every treasurer knows perfectly, anywhere in the world. To organize reporting from subsidiaries, nothing can beat an Excel template to send to each treasurer. This obviously requires a flawless organization in order to monitor the answers of each and to ensure the consistency of the results, but it is a method that works!

An alternative could be to implement the same TMS software (or at least some of its modules) in all of the group’s subsidiaries. But with the cost of licenses, added to integration with local information systems and change support, the investment budget would thus become extremely heavy. And above all, it would only make sense if 100% of the subsidiaries were equipped with it: a single exception, and you will need Excel again.

For this reason, according to the latest “AFTE Technical Report”, 59% of TMS users still prefer our dear spreadsheet to build their reports.

What should we make of this?

Obviously: Excel and TMS are not rivals, but rather good friends. Each one addresses the weaknesses of the other.

For companies with limited international presence, TMS and Excel are suitable. A treasurer who concentrates his activity on treasury management, and for whom cash flow forecasts and reports are not major issues, will be satisfied with TMS software.

For very international groups, it will be different. The combined use of Excel and TMS will be an undeniable reality. By combining the advantages of both tools, the Group Treasurer will have a complete solution enabling him to efficiently carry out all his tasks.

But beware: For an optimal combined use of Excel and TMS, it is essential for treasurers to consolidate Excel processes on a group-wide basis. Otherwise, inevitably, errors or guesswork (of yourself, your staff or the treasurers of your subsidiaries) will jam the system.

The advantage of a solution like Gathering Tools: It builds on your Excel processes by converting them into secure forms facilitating integration with the TMS and the information system.