As Group Treasurer, you have your habits, your methods, your tools. Yet, as you know, none of your colleagues work in the same way. It is therefore difficult to identify good practices and to see the guidelines in the profession. Although the issue of cash flow forecasting becomes more important each year, acquiring and consolidating reliable data remains difficult.

So, we’re going to try to clarify the situation through our (non-exhaustive) overview of methods and tools most widely used by major companies. Perhaps you will recognize yourself in this overview…

A diverse picture

As we said, cash flow forecasting is a growing issue within companies. There is an increasing need for management teams to be able to monitor available cash, and for several reasons: the 2008 crisis (scarcity of liquidity, volatility…) funding issues, and so on. Formerly confined to the finance department, cash data is now consulted by a large number of stakeholders. Their updating becomes more frequent and more strategic.

The day-to-day organization of a Group Treasurer has therefore been shaken up. In order to build these forecasts within increasingly shorter deadlines, the internal processes need to run perfectly. Indeed, in more than half of the cases, the forecasts depend on the information sent by the subsidiaries, but also by the various departments of the company (management control, commercial services, procurement and human resources). Genuine collaboration must, therefore, be achieved to ensure a flawless recovery of all of this information (see our article on this subject).

Frequently inadequate software

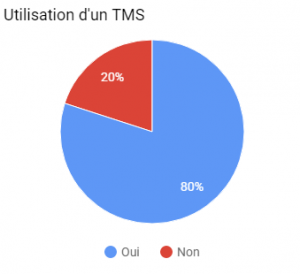

In order to gather the data needed to build cash flow forecasts as efficiently as possible, the reflex is often to turn to TMS software (Treasury Management Systems). Indeed, they have a significant role among the major groups, as shown in the graph opposite (source: Mazars’ study on cash flow forecasting within companies with a turnover of more than €1.8 billion): 8 out of 10 major companies use them. Among these systems, the most important are: Sage, Kyriba, Exalog…

In order to gather the data needed to build cash flow forecasts as efficiently as possible, the reflex is often to turn to TMS software (Treasury Management Systems). Indeed, they have a significant role among the major groups, as shown in the graph opposite (source: Mazars’ study on cash flow forecasting within companies with a turnover of more than €1.8 billion): 8 out of 10 major companies use them. Among these systems, the most important are: Sage, Kyriba, Exalog…

However, despite a significant equipment rate, these TMS do not completely satisfy the treasurers today. According to a study by AFTE*, although cash management tools have changed a lot in recent years, their functional coverage remains limited.

For the main functions of cash management – integration of statements of account, cash reconciliation and balance of accounts – TMS play their role very well. But when it comes to medium-term and long-term cash flow reporting or forecasting, TMS are struggling. In such a case, Excel comes first (59% of users choose Excel for their reporting, 25 to 33% for short-term forecasts and 53 to 71% for long-term forecasts, according to the AFTE Study).

Excel: a still essential tool, and for a long time

To build their forecasts, most of these companies have, therefore, set up a forecasting system at the group level. As we said, Excel is still the most used software for exchanges between the parent company and the subsidiaries. According to the Mazars study, less than 20% of the major groups have integrated these exchanges directly into their TMS.

Our dear spreadsheet therefore still has good days ahead of it to build cash flow forecasts. Nevertheless, it is essential to ensure data reliability and security, as Excel has many limitations. Such as ensuring that all recorded data is consistent, managing different versions of files or securing workbooks with VBA macros, etc. , which requires a considerable amount of time and precision. For a Group Treasurer, the slightest mistake can be dramatic and cost the company tens of thousands of Euros. He is therefore responsible for the quality of his files.

In order to facilitate the building and controlling of these forecasts, a solution exists: it is called Gathering Tools. It lets you consolidate and secure your existing Excel processes, whether they are integrated or not into a TMS software. This will enable you to build cash forecasts with more reliability, traceability, and speed.